peoples pension tax relief

Higher rate tax payers need to claim the remaining tax relief from HMRC. If they earn less than 3600 a year they can get tax relief on their pension contributions up to 3600 every year.

Detroit Tax Relief Fund Dtrf Wayne Metro Community Action Agency

About The Peoples Pension.

. You can benefit for example from the higher basic allowance or the flat-rate income tax allowance. Those paying 40 income tax are entitled to 40 pensions tax relief on contributions and 50 taxpayers are entitled to 50 tax relief although this will drop to 45. We call this method the net tax basis as your contributions are taken from your.

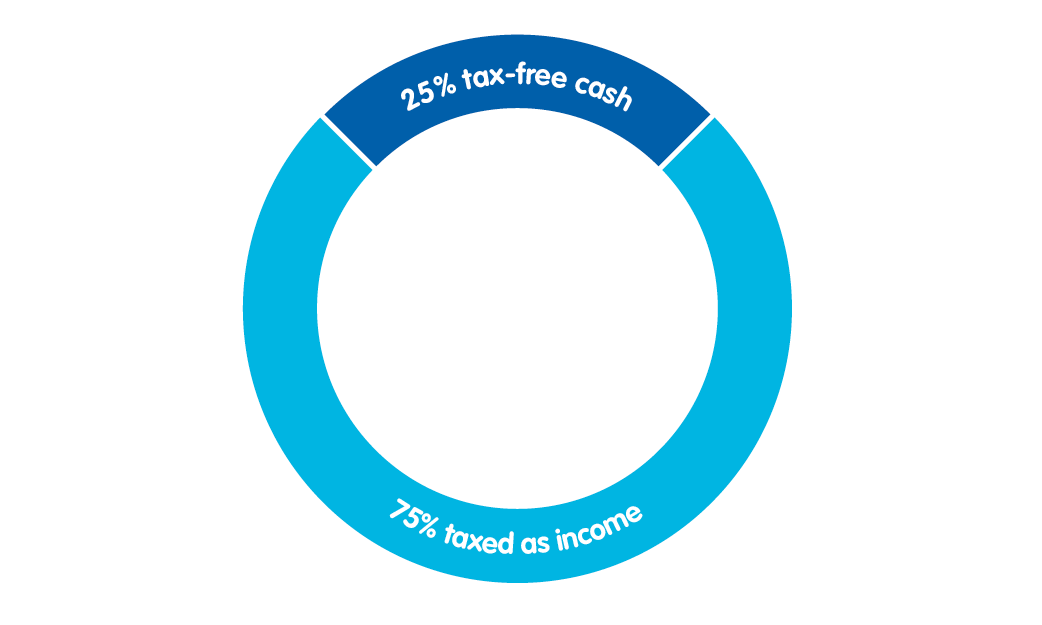

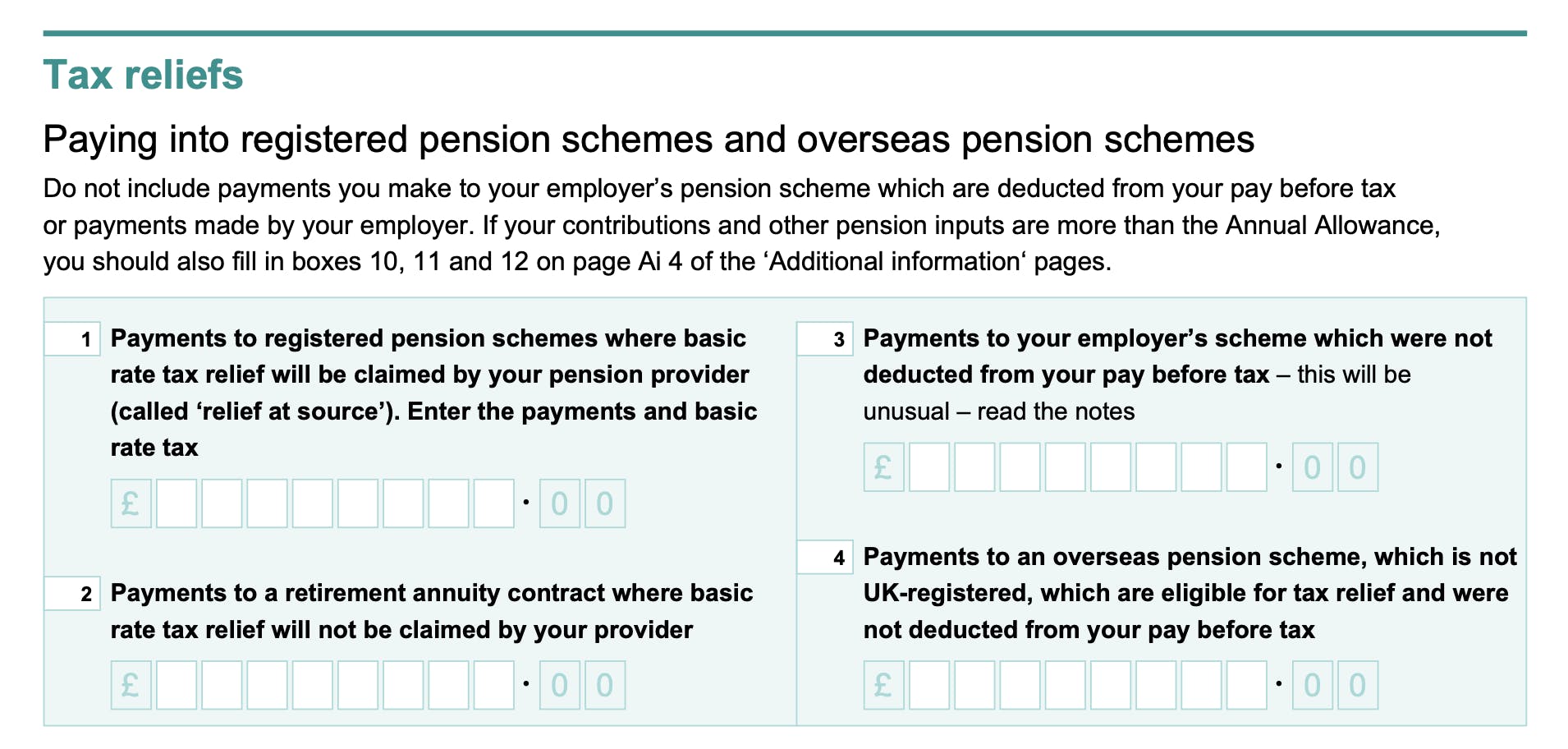

You may see HM Revenue Customs HMRC referring to this as the relief at source method. Each employee pays a bit into a pension pot. Your pension provider applies tax relief by claiming back the basic rate from HMRC to add to your pension savings.

Then we automatically claim tax relief for you adding the basic tax rate of 20 to your pension contributions. Relief at source is a deduction taken from an employees salary after tax is applied. Account Number Enter the account number allocated to you by The Peoples Pension during the set up of your account.

You still automatically get tax relief at 20 on the first 2880 you pay into a pension each tax year 6 April to 5 April if both of the following apply to you. I was given incorrect information not advice about how tax relief worked its different depending on how you pay in to your pension and how much you pay in. I contacted BCE explaining this with a whole lot of evidence including an email I was sent stating that whether you pay in from payroll or.

There are three options to select for tax relief. Relief at source Net pay arrangement or Salary sacrifice. If your employees dont pay tax as their earnings are below the annual standard personal allowance 12570 theyll still get tax relief on their pension contributions at the basic rate of 20 as follows.

The pension company will then add tax relief at 20 back into the members pension pot. Tax Relief at Source. You do not pay Income Tax for.

September 30 2015 BCE provider of The Peoples Pension has called for the current system of pensions tax relief to be replaced by a flat rate set high enough above the basic rate to encourage higher earners to save or matched government contributions. With this type of contribution the deduction is made after all tax and NI has been calculated and so from the employees net pay. Pension benefits Money back HM Revenue Customs gives tax relief on pension savings Award-winning for products knowledge and service.

How it works Each employee pays a bit into a pension pot employers pay in some more and tax relief is added too. Compare the Top Tax Debt Relief and Find the One Thats Best for You. Pension tax relief for non-taxpayers and low earners Non-taxpayers including spouses who arent in employment and children are eligible for tax relief of 20 even though they dont pay tax.

For higher earners the annual allowance can be reduced by as much as 30000 through a. Signing up to The Peoples Pension. This method of deducting pension contributions HMRC call relief at source RAS.

If employees are earning below the income tax threshold and contributing to a net pay scheme they will be missing out on a government top-up. For tax year 20162017 the rate is 20. The employee receives basic rate tax relief on that pension deduction.

Relief at source means your contributions are taken from your pay after your wages are taxed. Lost tax relief due to incorrect information. When you first visit this screen the No tax relief box is checked.

This includes the government top-up of 20 so they. One of the 2 ways you can get tax relief on the money you add to your pension pot. Members will get tax relief based on their residency status at the relevant basic rate that.

And youll find useful information on our website. If you retire this year you have to pay tax on 82 percent of the gross pension Created. Peoples Tax Relief offers tax relief services to help US.

Employers should be aware that there are two different ways of enabling employees to get tax relief on their pension contributions to defined contribution DC pension schemes. Provider type Select The Peoples Pension from the drop-down list. Tax change 2022.

Administering an account with The Peoples Pension. Higher rate tax payers may need to claim money back via their Self-Assessment tax return. It is very important that you determine the correct tax relief method for your particular pension.

Relief at source is a way of giving tax relief on contributions a member makes to their pension scheme. Then we invest it all to build up money for retirement. You can find more information about tax relief on wwwgovuktax-on-your-private-pensionpension-tax-relief.

Carina Blumenroth More relief for taxpayers is coming this year. From 1 April 2022 this is 950 per hour for those who are over 25 known as the National Living Wage. Net tax basis deducting contributions after tax When you sign up to The Peoples Pension well automatically set you up on the net tax basis.

Lower life cover this is because employers generally work out the entitlement as a multiple of salary and salary sacrifice makes that salary lower. Understand the tax relief options. In payroll if say the employees pension deduction is 1 you would enter 1 in the employees pension deduction.

Thats why we call this tax basis net Then The. Remember you can save 100 of your income into a pension to earn tax relief so long as it doesnt exceed 40000 in a year. If as outlined above you have no earned income whatsoever the maximum amount you can save into a personal pension and still receive tax relief is 3600 gross per annum.

General Data Protection Regulation GDPR Product and scheme information. There are a few downsides to consider with salary sacrifice. Under this tax basis youd deduct employee contributions from their pay after tax is taken.

Employers could face criticism or even claims if their. In 2022 there were several changes in tax and finance.

Pension Tax Relief On Pension Contributions Freetrade

What Are Defined Contribution Retirement Plans Tax Policy Center

60 Tax Relief On Pension Contributions Royal London For Advisers

Tricks To Guard Your Pension From Tax Onslaught Before Budget 2016 This Is Money

Opting Out The People S Pension

Higher Income Tax How To Claim Pension Tax Relief Extra 20 Boost Youtube

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Tax Relief On Your Pension Youtube

Pension Tax Relief On Pension Contributions Freetrade

What Is Pension Tax Relief Nerdwallet Uk

Pension Tax Relief On Pension Contributions Freetrade

How To Add Pension Contributions To Your Self Assessment Tax Return

Auto Enrolment Tax Relief Workplace Pensions Aviva

Michigan S Pension Tax To Likely Vanish But Questions On Broader Tax Cut Bridge Michigan

60 Tax Relief On Pension Contributions Royal London For Advisers

How Do Pensions Work Moneybox Save And Invest

How Pension Tax Relief Works And How To Claim It Wealthify Com